Advantages of Currency Options

The best rated Advantages of Currency Options broker IC Markets offers competitive offers for Forex CFDs Spread Betting Share dealing Cryptocurrencies. Currency trading is a specialized skill and requires familiarity with the economies of the countries whose currencies you will trade as.

Currency Options And Options Markets Ppt Download

What assumption about the managements preferences.

. The currency option bond gives the bondholder the right to receive the principal and interest payments in either USD or GBP. Advantages of OTC FX options. Of course when the trade doesnt go your way options can exact a heavy toll.

Flexibilty Options allow traders to protect. Many commentators compare options to another final product. Find Out What Services a Dedicated Financial Advisor Offers.

The final benefits advantage of options is they offer more investment alternatives. Ad See how Invesco QQQ ETF can fit into your portfolio. For related reading see.

Ad Numbers Tell Only Half The Story. We Reviewed the 10 Top Gold Investment Providers For You. Advantages of Foreign Currency Options.

Do you have enough money. Financial institutions hedge their positions by buying and selling. However it can be tricky to get a good fill during periods of high volatility.

For a premium you get the management to buy or sell a currency at a certain rate. This is your one stop shop. It is not an obligation it grants the right to buy or sell currency in the future.

This form of trading coalesce Forex market with Options. First an option can be exercised to hedge the risk of loss while still leaving open. Ad Financial Advisors Offer Many Services Insights for Saving.

Your Investments Deserve The Full Story. The main difference between the two is that in currency options trading their values are determined at a specific time period. This is a substantial advantage of futures over options.

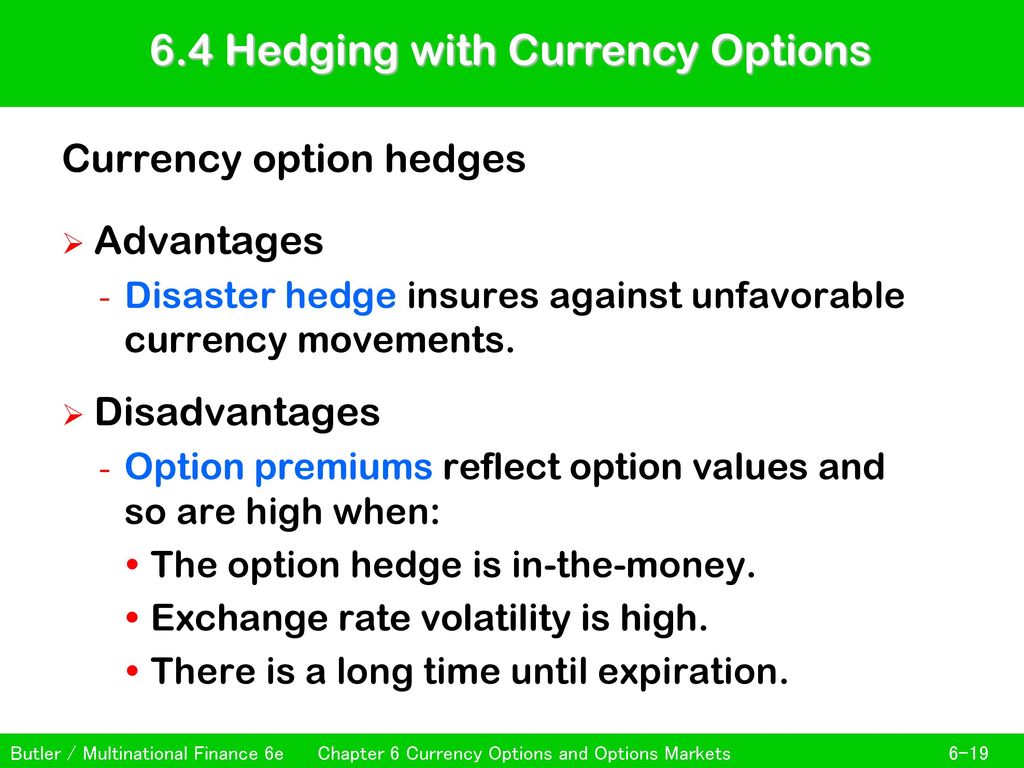

Deposit what works best for you. There are many advantages of currency options trading. The most important advantage of currency option is to risk coverage through hedging the risk of exchange rate fluctuations is covered through the currency options but the investor will lose.

Advantages of Forex Options Trading. Ad Heres how ordinary people are earning 5000 - 20000 each month in their spare time. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment.

A currency option is a contract that grants the buyer the right but not the obligation to buy or sell a specified currency at a specified exchange rate on or before. Financial Planning is complicated let us simplify it for you. Ad Your CD performance isnt tied to market variability so theres no risk involved.

Advantages of using currency options Euros. You can delve into the forex market with minimal losses once you invest in Forex Options. Buying an option can benefits seen as a form of insurance.

The Advantages of Currency Options. The exchange rate and the coupon rate are fixed. Theres no minimum balance to open a CD account.

Ad Your CD performance isnt tied to market variability so theres no risk involved. Ad Diversify Your Retirement Portfolio by Investing in Gold IRAs. Also the listed options are.

Deposit what works best for you. With OTC FX options you pay a premium for the. The main advantage of OTC options is that the options are tailored to meet the specific needs of a firm.

Options allow you to create unique strategies to take advantage of different characteristics of the market - like volatility and time decay. There is also the possibility of slippage during periods of instability just as in any other market. Ad Trade with the Options Platform Awarded for 7 Consecutive Years.

Ad Youve worked your whole life to build wealth for retirement. Advantages of currency option. Options have great leveraging power.

Options allow you to take a. Protect Yourself From Inflation. Unlike currency forwards where you buy currency for a specific date in the future and are locked into the deal.

See how this trading course helps small investors earns Extra Income. First an Australian corporation can uses currency options to get right in order to hedge its exposure in euros. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

A foreign currency option provides two key benefits. Open an Account Now. With OTC FX options you pay a premium for the.

Theres no minimum balance to open a CD account. As the buyer of the option you do not. What type of product is it and what is the basis for the comparison.

Unlike a forward transaction the client. A CURRENCY OPTION allows clients to secure their funds against unfavourable changes to exchange rates as is the case of a forward transaction. Advantages of OTC FX options.

As such an investor can obtain an option position similar to a stock position but at huge cost savings. Unlike currency forwards where you buy currency for a specific date in the future and are locked into the deal. The more volatile the underlying or the broad market the higher the premium paid by the option buyer.

Free Currency Tips Stock And Nifty Options Tips Commodity Tips Intraday Tips Rupeedesk Shares Day Trading Day Trading Stock Options Trading Trading Charts

Momentum Trader Stock Trading Strategies Forex Trading Quotes Options Trading Strategies

/close-up-of-computer-monitor-946388998-a64b758052274786b2c0a57891cf9fce.jpg)

Comments

Post a Comment